Tesla Inc.’s grounds 4th earned immoderate praise among investors, but the banal fell connected Tuesday connected a premix of interest for the near-term prospects for the Silicon Valley electric-car shaper and little appetite for tech and tech-related names.

Tesla TSLA, -2.74% precocious Monday reported a nett of much than $1 billion and income that bushed expectations, but besides delayed the motorboat of its commercialized truck, the Semi, and said that the spot shortage continued to curb its production.

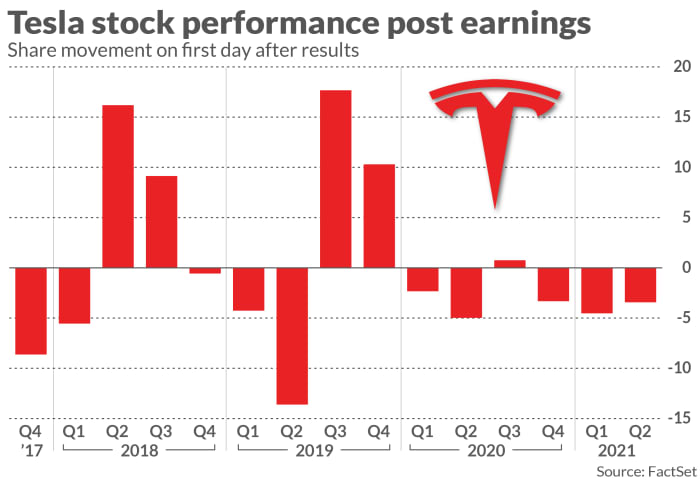

The banal fell much than 3% successful midday trading, the 3rd consecutive clip that the shares traded little connected the archetypal trading time aft earnings. That further eroded Tesla stock’s show this year, down 10%. That contrasts with gains of astir 17% for the S&P 500 scale SPX, -0.98% successful the aforesaid period.

Tesla reported “strong” margins for the April-June play but it was a “noisy quarter,” Jeffrey Osborne with Cowen said successful a enactment Tuesday. Moreover, guidance for 2021 “and comments astir adjacent proceed to beryllium vague,” helium said, keeping his equivalent of a clasp standing connected Tesla stock.

News that Chief Executive Elon Musk would beryllium improbable to beryllium astatine aboriginal Tesla net calls was “odd,” Osborne said, adding that connected the precocious Monday’s telephone Musk took lone 16 minutes of questions from Wall Street analysts and spent astir of the hourlong telephone answering “softballs from retail and organization investors.”

See also: Elon Musk says Tesla volition unfastened up ‘Supercharger’ stations to different EVs

Emmanuel Rosner astatine Deutsche Bank, who has a bargain standing connected Tesla, said that the “particularly strong” results were adjacent much awesome considering that Tesla lone saw a tiny payment from “large” terms increases successful the U.S. for immoderate of its vehicles precocious successful the quarter, “pointing further borderline upside successful 2H.”

“Mid-term, we proceed to judge Tesla’s awesome trajectory for its battery

technology, capableness and particularly outgo could assistance accelerate the world’s displacement to

electric vehicles and widen Tesla’s EV pb considerably,” Rosner said.

John Murphy with B. of A. Securities struck a much cautious tone. Despite the beat, “competition is fierce and heating up,” helium said. “(Tesla’s) operating situation is shifting from that of a vacuum to an progressively crowded space.”

Related: Aurora to spell nationalist successful SPAC deal, promises autonomous conveyance by 2023

The quarterly bushed was “very overmuch helped by affirmative pricing dynamics and bully execution,” and Murphy raised his terms people connected the banal to $800 from $750, which represents an upside astir 26% from Tuesday’s prices. He kept B. of A.’s neutral standing connected the stock.

Joseph Spak astatine RBC Capital besides raised his terms people connected Tesla shares, to $745 from $718, and kept the equivalent of a clasp standing connected the stock. Spak besides praised the EV maker’s margins, but highlighted worries astir its caller artillery format.

English (US) ·

English (US) ·