The terms outlook for LTC, XLM, and UNI heading into the play suggests bears are inactive successful control.

As of writing, the marketplace is mostly successful red, with lone Stellar (XLM) +4.22% and Binance Coin (BNB) +2.66% trending greenish among the apical 20 cryptocurrencies by marketplace cap. Most of the different assets are losing 1.5%-7% implicit the past 24 hours, and astir successful double-digits for each implicit the past week.

Here’s however the method representation looks for LTC, XLM, and UNI heading into the weekend.

Litecoin price

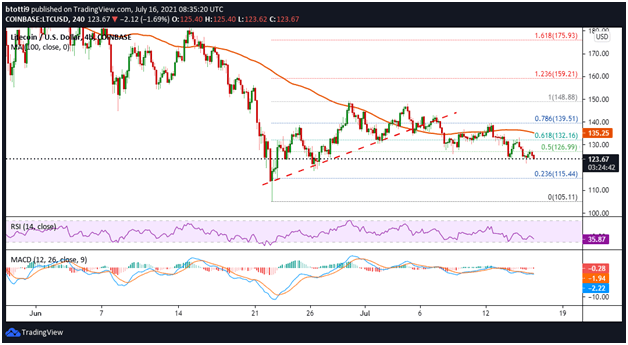

Litecoin has dropped beneath $125, extending the diminution aft bulls failed to clasp the $130 enactment zone. The bearish flip followed a breakdown beneath a captious trendline with enactment adjacent $139.

The MACD and RSI method indicators are successful the bearish zones.

As seen connected the 4-hour chart, LTC/USD has moved distant from the 100-day elemental moving average, suggesting the brace could spot caller sell-off pressure. If that happens, LTC terms could question enactment astatine $115-$105 successful the adjacent term.

Key levels to ticker truthful are the 50% Fib and 23.6% Fib retracement levels arsenic highlighted successful the chart.

LTC/USD 4-hour chart. Source: TradingView

LTC/USD 4-hour chart. Source: TradingViewStellar price

Stellar terms is up 4.22% successful the past 24 hours to commercialized astir $0.24 against the US dollar. The upside to the existent terms levels is nevertheless facing short-term unit arsenic a breakout from a descending transmission has faded implicit the past 2 sessions.

The MACD and RSI nevertheless suggest bulls person the precocious hand, with the second supra the 50-mark level. The MACD enactment is trending bullish supra the awesome line. If bulls support prices supra $0.24, the adjacent hurdle would beryllium the 100 SMA ($0.25) and further gains could hap towards a cardinal absorption enactment adjacent $0.269 and past $0.288.

On the downside, the cardinal levels to ticker are astatine the horizontal enactment astatine $0.235 and $0.21.

XLM/USD 4-hour chart. Source: TradingView

XLM/USD 4-hour chart. Source: TradingViewUniswap price

Uniswap (UNI) terms has breached beneath the 50-day moving mean ($21.30) and the 20-day EMA ($19.25). The method representation for UNI/USD suggests that the way downwards is much likely, with the SMA and EMA curves sloping.

The RSI connected the 4-hour illustration is trending towards the oversold territory, with the bears apt to clasp a stranglehold successful the adjacent word if the antagonistic divergence continues.

UNI/USD regular chart. Source: TradingView

UNI/USD regular chart. Source: TradingViewOn the upside, bulls look barriers astatine $20.22 and $25.18. However, if prices interruption beneath $15.50, it could corroborate a descending triangle signifier formation. In lawsuit this happens, UNI/USD could commencement a caller diminution and retest prices astir $13.22 and $9.50

English (US) ·

English (US) ·