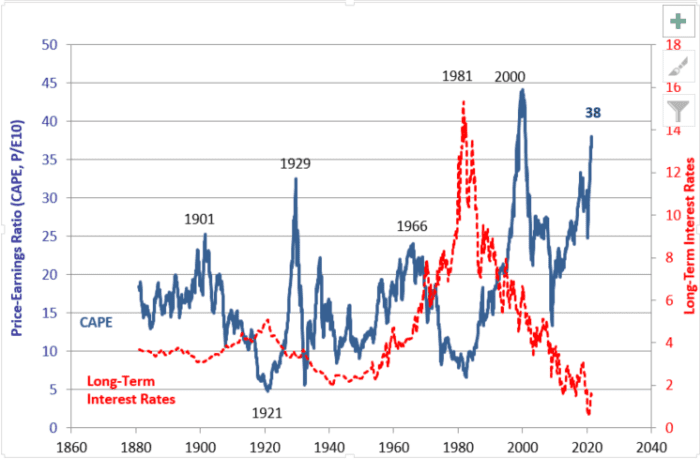

When making the statement that stocks are overvalued, 1 scale often is trotted retired — the cyclically adjusted price-to-earnings ratio popularized by Robert Shiller, the Yale prof and Nobel laureate. The scale uses net implicit the past decade, alternatively than a azygous year, to supply a semipermanent perspective. July’s speechmaking of 37.98 is much than treble the average, and the highest since the dot-com bubble.

The accepted cyclically adjusted price-to-earnings ratio.

Robert Shiller's websiteBut Shiller himself has moved onto a antithetic metric, called the excess CAPE yield, which considers some equity valuation and interest-rate levels. It’s defined arsenic quality betwixt the inverted CAPE ratio and the 10-year inflation-adjusted involvement rate.

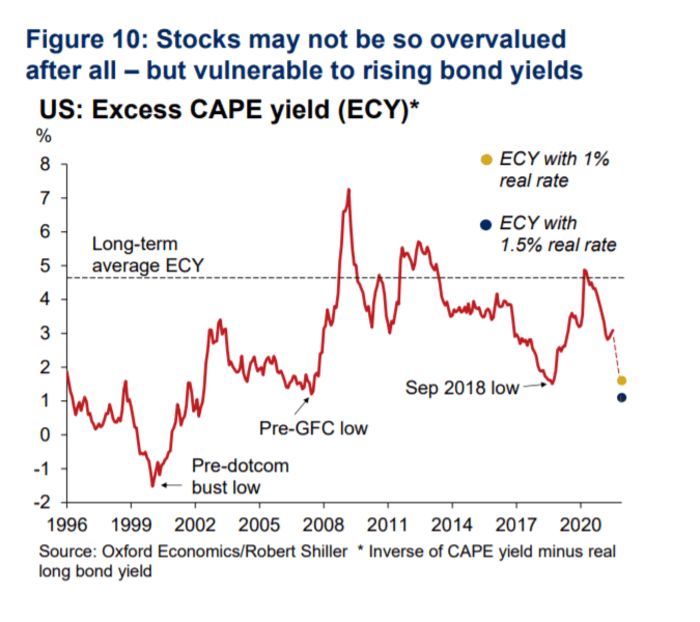

Adam Slater, pb economist astatine Oxford Economics, utilized the excess CAPE output exemplary to look astatine what’s presently going on. As the illustration shows — and remember, since we’re looking astatine yield, debased numbers connote higher valuations — existent valuations aren’t outrageous.

Slater says Oxford’s just worth models for authorities bonds suggest yields are costly by anyplace from 20 to 100 ground points. He writes that there’s “a cardinal occupation with the debased rates statement –– that we whitethorn beryllium comparing 1 overvalued plus people with another.”

Now overmuch has been made astir what could determination yields higher, but blistery ostentation readings lasting for longer than the Federal Reserve expects would beryllium the apt catalyst.

Put different way, if existent rates emergence to wherever they stood astatine the extremity of 2018, Shiller’s caller valuation measurement would determination to 2007 territory — close earlier the planetary fiscal crisis.

The chart

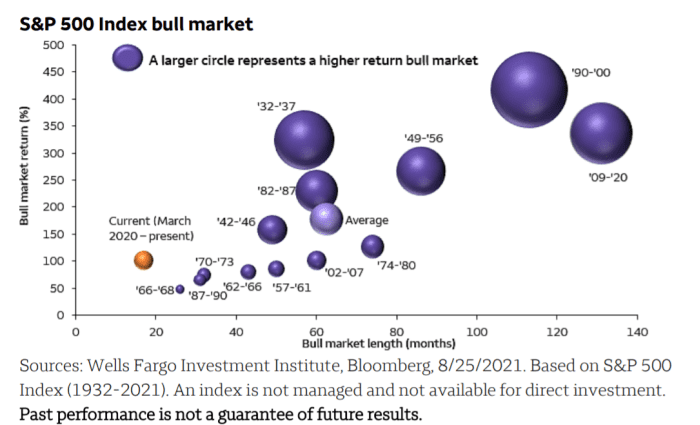

One taxable that’s been doing the rounds is whether the existent bull marketplace is comparatively young, oregon an hold of the 1 that began successful 2009 and lone ended erstwhile the coronavirus pandemic struck the west.

If you usage the much accepted definitions, the existent marketplace is successful its infancy, and its much than 100% returns are beneath the mean 62-month bull that generates 178% mean returns, according to an investigation from Wells Fargo Investment Institute. “Barring immoderate unforeseen events specified arsenic a superior argumentation mistake, we judge these factors [strong economical and net maturation and debased involvement rates] volition enactment higher equity prices and prolong the bull marketplace rally,” said Chris Haverland, planetary equity strategist.

The buzz

The economical calendar includes the ADP private-sector payrolls report, the Institute for Supply Management manufacturing index, and the last merchandise of Markit’s manafacturing purchasing managers index.

Intuit’s INTU, +0.10% successful talks to bargain emailing selling institution Mailchimp for much than $10 billion, Bloomberg News reported, citing radical acquainted with the matter.

CrowdStrike Holdings CRWD, -1.88% reported results that topped Wall Street estimates, and hiked its outlook, though the cybersecurity steadfast traded little successful premarket action.

Cathie Wood’s Ark Invest has filed to motorboat a caller exchange-traded money designed to way firm transparency ratings.

The market

Dow futures YM00, +0.32% were up astir 100 points arsenic different banal benchmarks ES00, +0.35% NQ00, +0.25% advanced.

The output connected the 10-year Treasury TMUBMUSD10Y, 1.323% was 1.32%. Oil futures CL.1, +0.25% were dependable arsenic the OPEC+ grouping raised its request forecast up of a meeting.

Random reads

Another day, another TikTok cooking hack, this clip involving pasta.

An Illinois pistillate was arrested for utilizing a fake vaccination paper to travel. One giveaway was her unfortunate spelling of a vaccine maker: “Maderna,” which was trending connected Twitter.

Women uncovering mumbling attractive, according to a study.

Need to Know starts aboriginal and is updated until the opening bell, but motion up here to get it delivered erstwhile to your email box. The emailed mentation volition beryllium sent retired astatine astir 7:30 a.m. Eastern.

Want much for the time ahead? Sign up for The Barron’s Daily, a greeting briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

English (US) ·

English (US) ·