Bitcoin’s (BTC) terms declined by 8% this past week arsenic sell-off unit continued to headdress buyers. The benchmark cryptocurrency adjacent touched a debased of $31,025 connected Coinbase.

On the play chart, BTC recorded a candle adjacent of $31,788, the lowest the cryptocurrency has seen since the penultimate week of 2020.

As of writing, Bitcoin is trading adjacent $31,400 and though it could yet rebound disconnected enactment astatine $31k, it remains anemic arsenic method indicators suggest further unit successful the adjacent term.

BTC terms outlook

Last week, the BTC terms dropped and posted a bearish candle for the 2nd week running. It’s besides present 4 retired of 5 successful the reddish implicit the past fewer weeks. The alteration saw BTC/USD descend to a play debased of $31,025, and yet a play candle adjacent that’s the lowest since the $26,258 recorded during the week of December 21-28 past year.

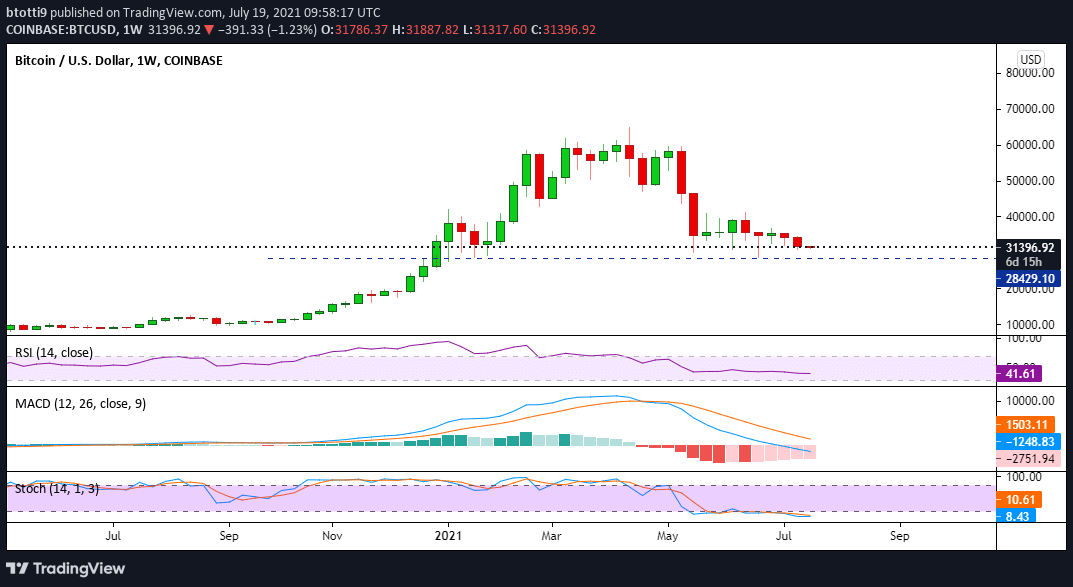

BTC/USD play terms chart. Source: TradingView

BTC/USD play terms chart. Source: TradingViewTechnical indicators enactment a short-term bearish continuation. The play RSI is beneath 50 and sloping, portion the MACD continues to inclination little aft a bearish crossover. A look astatine the Stochastic oscillator reveals a akin outlook, with the indicator successful the oversold territory aft precocious forming a bearish cross.

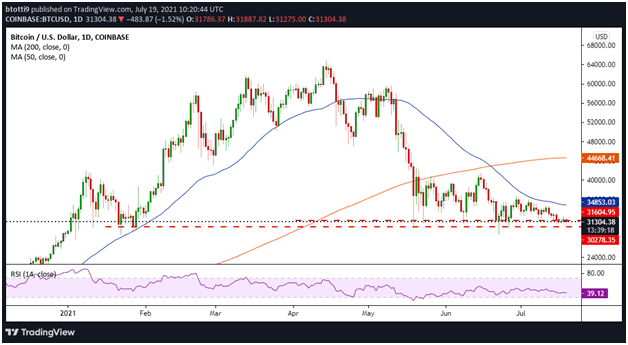

Bitcoin terms regular chart. Source: TradingView

Bitcoin terms regular chart. Source: TradingViewOn the regular chart, Bitcoin remains capped beneath the 50-day moving mean (50 SMA) aft forming a decease transverse connected 19 June. The regular RSI besides suggests bears person the precocious hand.

BTC/USD is present beneath a semipermanent horizontal enactment enactment formed astatine the $32,050 zone. It’s besides beneath short-term horizontal enactment astatine $31,604. If the terms falls beneath $31k, enactment is apt astatine $30,278 and perchance $28,400.

On the upside, bulls could propulsion supra $32k and people caller gains astir $32,800-$34,880.

English (US) ·

English (US) ·