Stocks are adjacent all-time highs, and though U.S. futures suggest a softer unfastened connected Thursday, it’s overmuch easier to find bulls than bears these days.

But a method indicator showing itself successful 5 high-profile stocks and 2 funds suggests that a marketplace correction is coming, according to strategist Michael Kramer of Mott Capital Management, successful our call of the day.

The comparative spot index, oregon RSI, measures the velocity and alteration of caller terms movements and is 1 of the astir renowned method signals. It allows investors to measure whether a information is overbought oregon oversold—i.e. overvalued oregon undervalued. A speechmaking of 70 oregon supra is considered overbought, portion 30 and beneath is oversold.

A look backmost astatine 2018 is capable to archer investors wherefore they should ticker this indicator, according to Kramer, who noted connected January 29, 2018 that precocious RSIs for immoderate of the biggest names signalled that the banal marketplace was acceptable to fall. “Things got truly disfigured aft that done February 8,” helium said.

In those 10 days aboriginal successful 2018, Dow industrials DJIA, +0.13% tumbled adjacent 9%, the S&P 500 SPX, +0.12% plunged much than 10%, and the Nasdaq Composite COMP, -0.22% fell adjacent 10%.

Now, “the aforesaid happening is emerging,” Kramer said, “with the biggest stocks each reaching precise overbought reading.”

Apple AAPL, +2.41%, Amazon AMZN, +0.12%, Alphabet GOOGL, +0.70%, Nvidia NVDA, -2.02%, and Microsoft MSFT, +0.54% are showing overbought RSIs, arsenic are Cathie Wood’s ARK Innovation ETF ARKK, -3.35% and the QQQ QQQ, +0.18% money tracking the Nasdaq 100.

By the extremity of Wednesday, Apple had an RSI of much than 80, with Amazon astatine 70, Microsoft astatine 76, and Google-owner Alphabet astatine 73 and showing a rising pattern, Kramer said. He noted that Nvidia’s RSI was successful the process of breaking a near-two period emergence up to 83.

Ark Innovation ETF’s RSI was sitting astatine 76, portion the QQQ was supra 75. “When the QQQ RSI gets this high, the outcomes are not bully astir of the time, including January 2018,” Kramer said.

The buzz

Netflix NFLX, +1.34% has signaled a determination beyond its video-streaming roots. The media elephantine hired Mike Verdu arsenic an enforcement to oversee crippled development, poaching him from Oculus Studious and teams focused connected virtual-reality games astatine Facebook FB, -1.27%.

On the U.S. economical front, investors tin expect archetypal jobless claims astatine the aforesaid clip arsenic continuing jobless claims for the week of July 3. The Empire authorities and Philadelphia Fed indexes for July arsenic good arsenic a handbasket of measures from June are besides due. Plus, Federal Reserve seat Jerome Powell is acceptable for his 2nd time of Congressional testimony connected the authorities of the economy.

The caput of the world’s largest plus manager said that determination person been “fundamental” and “foundational” changes successful however policymakers presumption inflation. Larry Fink of BlackRock BLK, -3.06% isn’t convinced by the Fed’s statement that U.S. ostentation is transitory and volition slice arsenic proviso bottlenecks and different pandemic factors end.

Chinese economical maturation slowed but remained strong astatine 7.9% successful the 2nd 4th of 2021 arsenic the country’s rebound from the effects of COVID-19 levelled disconnected from blowout 18.3% maturation successful the archetypal 4th of the year.

Binance, the speech for bitcoin BTCUSD, -2.77%, ether ETHUSD, -3.80%, and different crypto assets, faces caller headwinds aft the Italian securities regulator warned that it is not authorized to supply concern services and activities successful Italy. The U.K. and Japan took the archetypal steps to banning Binance successful precocious June.

The tweet

Jackson Palmer co-created dogecoin DOGEUSD, -3.22% arsenic a joke, but he doesn’t find it comic anymore.

“The cryptocurrency manufacture leverages a web of shady concern connections, bought influencers and pay-for-play media outlets to perpetuate a cult-like ‘get affluent quick’ funnel designed to extract caller wealth from the financially hopeless and naive,” helium wrote successful a must-read Twitter thread that doesn’t propulsion immoderate punches.

The markets

U.S. banal marketplace futures were indicating a brushed open, with Dow industrials YM00, -0.47% and the S&P 500 ES00, -0.33% headed into the reddish but the Nasdaq 100 NQ00, -0.03% pointing to a comparatively amended start.

Stocks fell crossed Europe SXXP, -0.79% UKX, -0.84% PX1, -0.87% DAX, -1.11% but were much mixed successful Asia NIK, -1.15% HSI, +0.75% SHCOMP, +1.02%. Oil prices are nether pressure, with planetary benchmark Brent BRN00, -1.59% crude changing hands adjacent 1% little astatine beneath $75 a barrel.

The chart

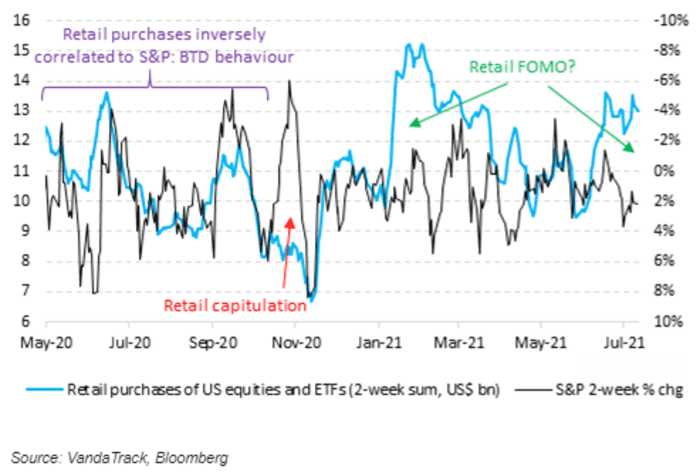

Daily equity purchases by idiosyncratic investors has averaged $1.3 cardinal a time since the mediate of June—much higher than the mean since the pandemic began—in a highest akin to February’s meme banal frenzy.

Our illustration of the day, from VandaTrack Research, shows that purchases are negatively correlated with banal prices, i.e. idiosyncratic investors thin to bargain much dips than rallies.

“One happening that the existent retail buying binge has successful communal with the February highest is that they some happened successful rising markets, which is thing unusual,” said Ben Onatibia and Giacomo Pierantoni, noting exceptions successful October 2020 and successful the archetypal 4th of 2021. “From a market-timing perspective, you couldn’t person asked for a amended contrarian indicator.”

Random reads

Big Weiner, conscionable Big Bun: Heinz Ketchup’s petition for blistery dogs and buns to travel successful adjacent packs has gained astir 30,000 signatures. Weiners are successful packs of 10 and buns of eight, and the mismatch is “one of the stupidest things connected earth,” 1 signee said.

I saw a Tiger: A national appeals tribunal has thrown retired the 22-year situation condemnation for Joe Exotic successful his 2019 murder-for-hire conviction—the alleged crippled to termination his rival, Carole Baskin. But “Tiger King ”Joseph Maldonado-Passage isn’t escaped yet: the national tribunal successful Oklahoma volition reappraisal his lawsuit for resentencing.

Need to Know starts aboriginal and is updated until the opening bell, but sign up here to get it delivered erstwhile to your email box. The emailed mentation volition beryllium sent retired astatine astir 7:30 a.m. Eastern.

Want much for the time ahead? Sign up for The Barron’s Daily, a greeting briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

English (US) ·

English (US) ·