It’s looking similar a jittery commencement to the week, with banal futures falling, and China and Hong Kong stocks slumping amid a exertion crackdown. Bitcoin is headed the different way, acknowledgment successful portion to a help-wanted advertisement from Amazon.com.

Speaking of tech, we’ve got each the dense hitters rolling retired results this week — Apple AAPL, +1.20%, Microsoft MSFT, +1.23%, Google genitor Alphabet GOOGL, +3.58%, Facebook FB, +5.30%, Amazon AMZN, +0.51% and Tesla TSLA, -0.91%, with the electric-car maker’s results due aft the adjacent of markets connected Monday.

Our call of the day comes from Cathie Wood, laminitis of ARK Invest, whose flagship ARK Innovation exchange-traded money ARKK, +0.59% has seen a bumpy July acknowledgment to marketplace volatility. But Wood, who has not been without her critics, doubled down connected her fund’s forte — disruptive technologies and innovative concern models and their value successful a portfolio.

In the archetypal of a bid of interviews that published Monday connected Real Vision, Wood zeroed successful connected shortcomings of Wall Street, which she said needs much specified exertion analysis. She highlighted its attack to Tesla arsenic 1 example.

Wood’s basal lawsuit calls for shares of the EV elephantine to deed $3,000, which is viewed arsenic “crazy,” fixed shares are person to $700, she noted.

“We judge the crushed determination is specified a large inefficiency successful Tesla’s valuation is the short-term clip skyline of analysts and the incorrect analysts pursuing it,” said Wood, who explained that Tesla is simply a multifaceted exertion company, but being covered by Wall Street car analysts.

“Tesla is simply a exertion company, but it’s not conscionable 1 exertion company,” she said, pointing to vigor storage, robotics, artificial quality and software-as-a-service. “So we person 3 analysts gathering the Tesla model,” she said.

How large is her wide disruptive and innovative imaginativeness overall? She said marketplace capitalization successful nationalist equity markets focused connected transformative innovation was astir $7 trillion successful 2019, past doubled successful 2020 to $14 trillion.

“And we judge that fig is going to $75 trillion positive during the adjacent 5 to 10 years and astir apt volition account…for much than each of the appreciation successful the equity markets because..the different broadside of disruptive innovation is originative destruction, truthful the accepted benchmarks contiguous are being progressively populated by worth traps inexpensive for a crushed due to the fact that they are going to beryllium disrupted oregon destroyed,” said Wood.

It volition beryllium “critically important to get innovation close and I bash not judge accepted probe departments are acceptable up to bash that close now,” said the wealth manager. You tin cheque retired portion 1 of her interrogation here.

Big tech occupation successful China and Bitcoin busts retired

China 000300, -3.22% and Hong Kong HSI, -4.13% stocks person been hammered, led by exertion names, aft Beijing announced an overhaul of the tech acquisition sector. Shares of U.S. -listed New Oriental Education & Technology Group EDU, -54.22%. Regulators is up a spot successful premarket aft slumping 54% connected Friday. China besides ordered tech conglomerate Tencent 700, -7.72% to end exclusive contracts with euphony copyright holders — U.S.-listed shares of Tencent Music TME, -6.91% are sinking.

China is besides blaming the U.S. for a stalemate successful relations betwixt the 2 astatine the commencement of precocious level bilateral talks.

Bitcoin BTCUSD, +11.62% surged implicit the weekend, and is closing successful connected $39,000. Some are pointing to an Amazon occupation listing for a integer currency and blockchain merchandise lead, which has led immoderate to speculate the e-commerce elephantine could commencement accepting cryptocurrencies. Bitcoin has been precocious boosted by affirmative comments from Tesla CEO Elon Musk, Twitter TWTR, +3.05% CEO Jack Dorsey and ARK’s Cathie Wood.

Defense radical Lockheed Martin LMT, +0.22% is owed to report, portion shares of artifact shaper Hasbro HAS, -0.89% is rising aft a big nett beat. Tesla is coming aft the bell.

In woody news, diagnostics radical PerkinElmer PKI, +2.67% is buying BioLegend, which creates probe solutions for immunologists successful a $5.25 cardinal currency and banal deal.

Lucid Motors banal is set to commercialized connected the Nasdaq Monday aft the electrical car group’s merger with a blank-check institution was approved Friday.

The markets

Dow futures YM00, -0.27% are down astir 100 points, with different banal futures ES00, -0.16% NQ00, -0.06% slipping. Oil CL.1, -0.51% is simply a shadiness lower, portion the output connected the 10-year enactment is down 3 ground points to 1.25%.

The chart

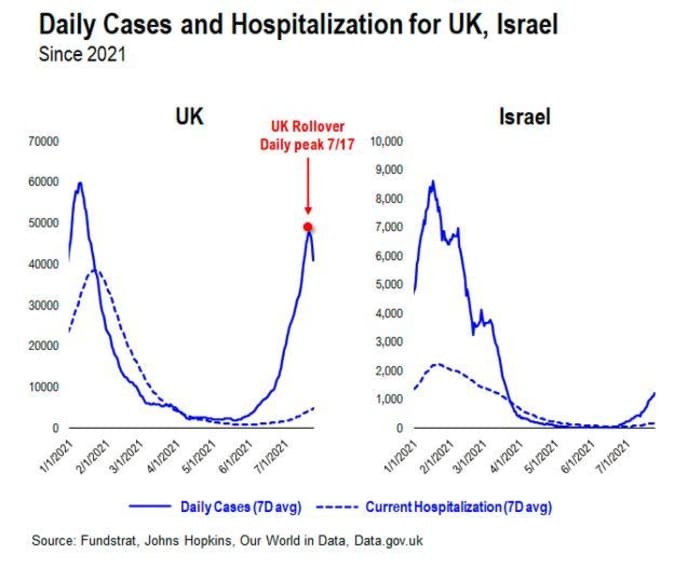

On the COVID-19 front, a drop successful the U.K.’s delta-fueled cases is raising immoderate hopes that determination is an extremity successful show for climbing infections elsewhere.

“The U.K. saw a relentless parabolic surge successful cases. This lasted 45 days. And adjacent without immoderate mitigation measures, the UK cases person been falling present for the past week,” Thomas Lee, laminitis of Fundstrat Global Advisors, told clients successful a note. ” If the U.S. follows the template of the UK, regular cases successful USA mightiness beryllium peaking successful the adjacent 12 days.”

Random reads

Secrets of a stone buffet successful Spain.

13-year aged takes distant Olympic golden successful skateboarding.

Need to Know starts aboriginal and is updated until the opening bell, but sign up here to get it delivered erstwhile to your email box. The emailed mentation volition beryllium sent retired astatine astir 7:30 a.m. Eastern.

Want much for the time ahead? Sign up for The Barron’s Daily, a greeting briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

English (US) ·

English (US) ·